Book Review: The Richest Man in Babylon

Book Review: The Richest Man in Babylon

08.10.2022 - By: Anastasia Barbuzzi

#RequiredReading refers to $HMONEY’s official book club. I review books in the personal finance genre several times a month, including titles related to personal finance such as lifestyle and mindset books. Have a book you want me to review before you dive in yourself? Send me a message! Happy to have you join in on the fun and learning 💚

Overview of The Richest Man in Babylon

Since I created $HMONEY Radio, I cannot tell you how many times I’ve heard the words, “You’ve gotta read this book.” A number of guests and acquaintances have fawned over The Richest Man in Babylon (TRMIB) prior to me cracking the spine of this small collection of parables by George. S. Clason.

Hailed as the “most inspiring book on wealth ever written,” TRMIB is considered a modern-day classic amongst finance professionals and has sold more than two million copies around the world.

The author of the book, George Samuel Clason, was a soldier, businessman and writer. He served in the United States Army during the Spanish-American War. It turns out, Clason was pretty entrepreneurial. He started two companies, the Clason Map Company of Denver Colorado and the Clason Publishing Company.

At this point you might be wondering what got him writing about personal finances in the first place. In 1926, he started writing a series of informational pamphlets about being thrifty and how to achieve financial success, and of course, they featured parables that were set in ancient Babylon.

Once completed, several banks and insurance companies began to distribute the parables. The most famous ones were compiled into what we know today as the book, TRMIB.

Overall, TRMIB promises to teach you:

how to save money

how to be thrifty

how to outsmart those who may want to take advantage of your wallet

who to entrust with your savings when investing money

lessons about financial planning

how to grow your personal wealth

how to create generational wealth

Theme

As I mentioned earlier, TRMIB is written in parables and set 4,000 years ago in Babylon, which is now known as Iraq. The book explores a number of themes including greed and happiness.

The collection of short stories follows the main characters as they tweak their moral compasses and pursue financially secure futures. Clason attempts to give new meaning to devotion and will; the determination to save and invest in yourself.

Via success stories of the ancients, Clason harps on his golden rule: save 10% of your income, no matter what. There’s something about his teachings that reminds me of what most millennials need to do to manage their debt: go back to basics.

Design & Structure

The formula of this book is simple. Each parable is a new story that branches off the last one’s theme. The parables compose very short chapters that are easy to get through (the first is only 16 pages).

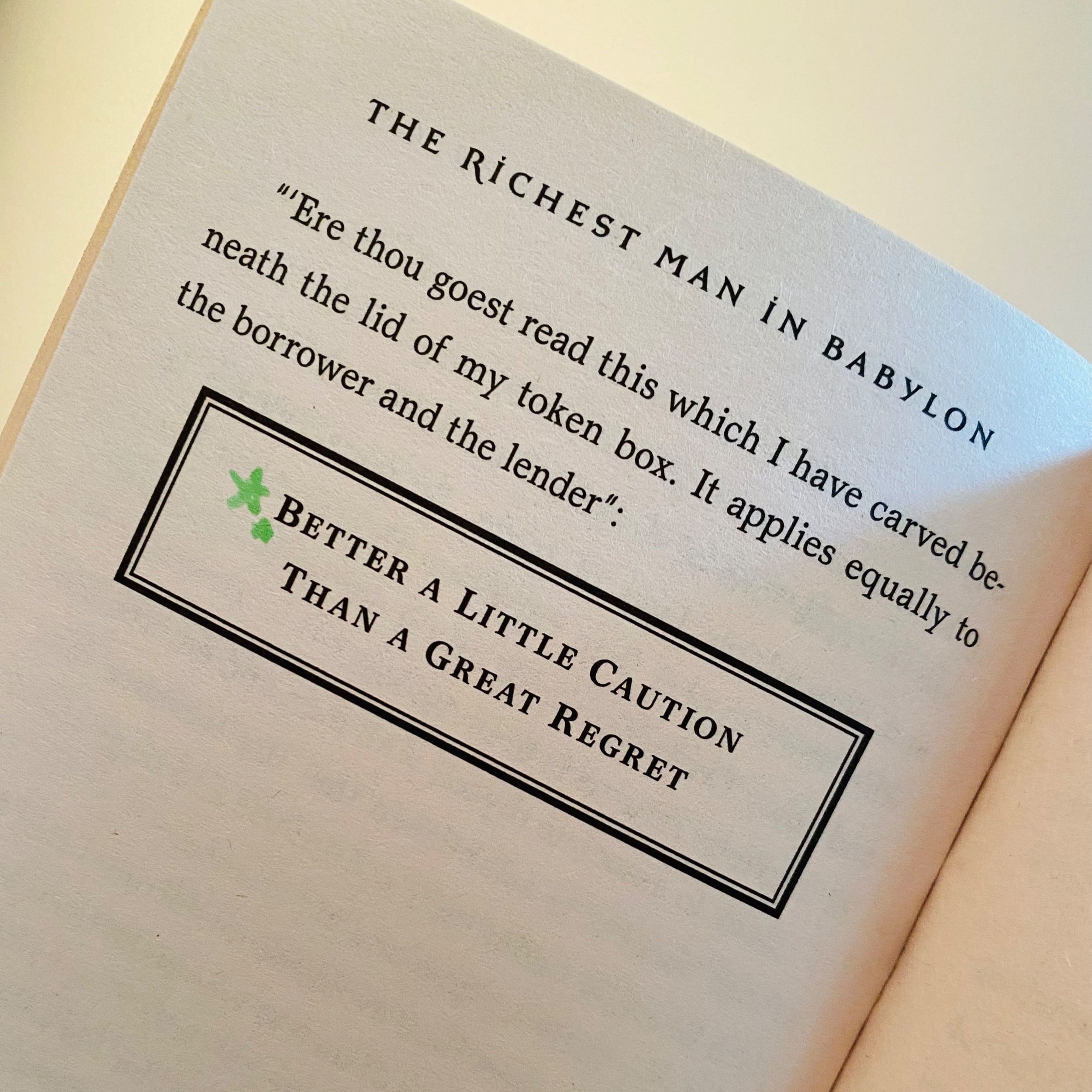

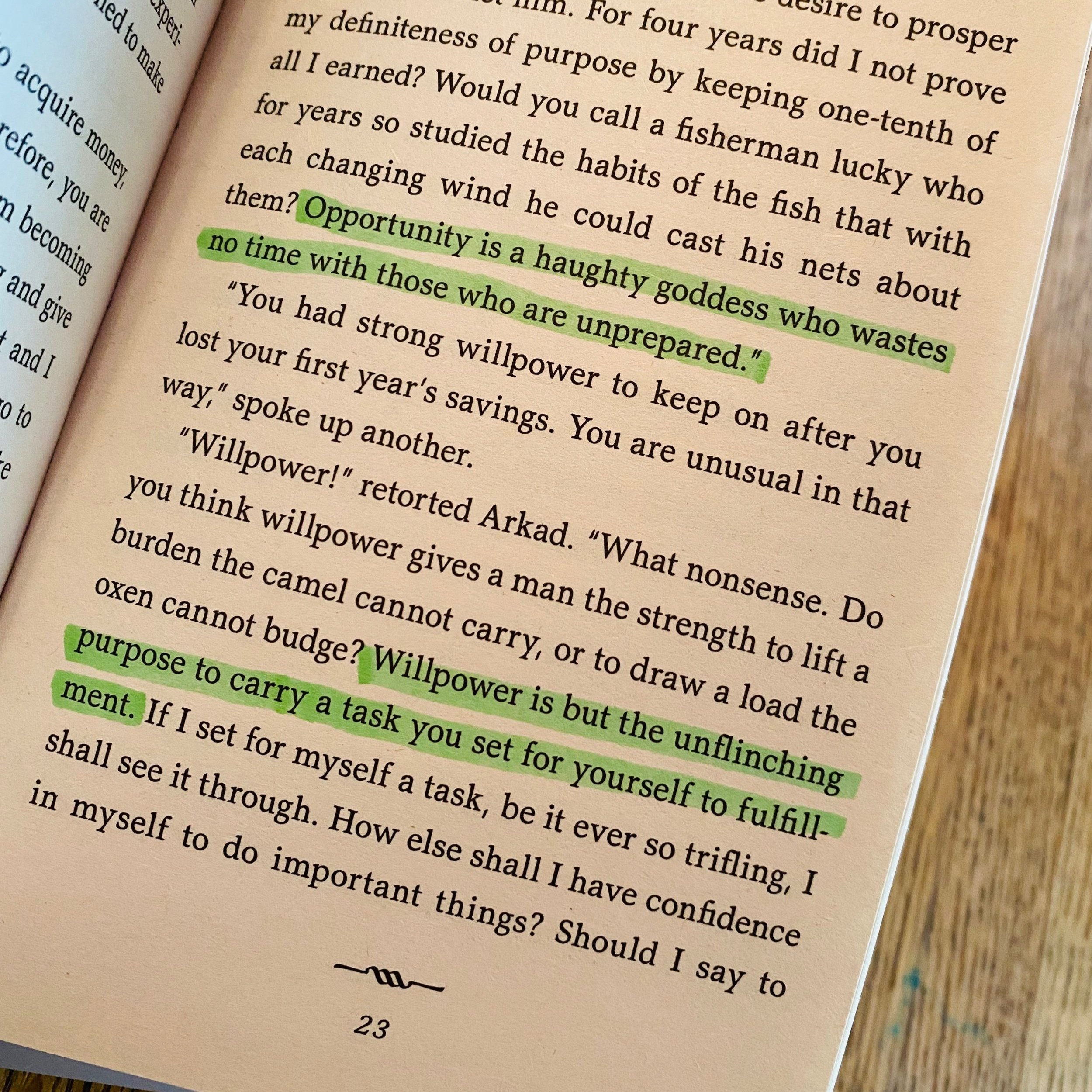

What I like about the structure of TRMIB and what I think works for a lot of readers is that each parable ends with a lesson. The lesson is typically quoted in a box that’s separated from the body text, making it easily distinguishable.

(ex. pictured below!)

Awards & Accolades: The Richest Man in Babylon

millions of copies sold

considered a modern-day classic around the world

recognized by many prominent personal finance experts as “the most inspiring book on wealth ever written”

millions claim TRMIB has changed their perception about wealth and money management

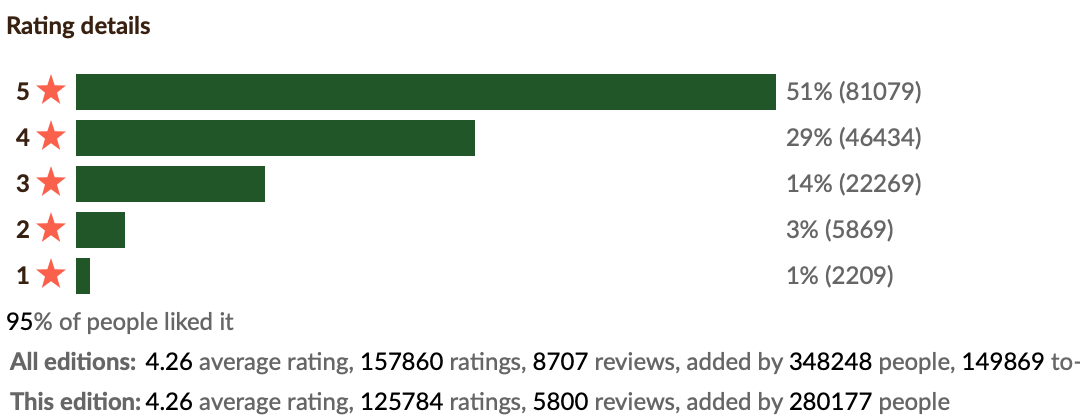

Goodreads Snapshot 📸: The Richest Man in Babylon

I refer to Goodreads, a platform for authors, publishers, and bookworms, for a variety of ratings and reviews. Keep up with my reading list here!

What People Are Saying About The Richest Man in Babylon

Since TRMIB is highly regarded amongst personal finance pros, I was a bit surprised to find such a mixed bag of reviews about the book. Let’s start with a 5-star opinion:

“I have always found books on personal finance exceptionally boring and have avoided reading them because of this. This book however takes the form of stories from Babylonian citizens each touching on an aspect of personal finance (save 10% of your earnings, don’t rent but rather own property and invest your money wisely so it may grow etc etc).

None of this is new to me however sometimes you need a reminder to jolt you out of bad financial habits.

I can highly recommend this and will be buying it as a Christmas present for a few people this year.”

This reader seemed satisfied with their choice to give this book a chance. Now let’s look at a more balanced 3-star review:

“Redundant? Yes. Simplistic? Yes. Necessary? Absolutely. Reading the book changes one's perspective on personal finances.”

After reading TRMIB myself, I can understand the comment about redundancy. As with many books about managing your personal finances, there’s not a lot of “new” information being shared (which inevitably leads to repetitiveness).

Before I move on, let’s take a look at a couple important 1-star reviews. First up:

“I'm not really sure who this book is meant for, are you wanting to learn about investing/saving this isn't a good book for that. Are you wanting to learn life lessons/self help, this isn't a good book for that. There is so little actual material to glean from this book and so much fluff and unnecessary banter.

I am not an overly religious person so the biblical background and setting do little to help me enjoy the book. Much of the little substance actually in the book is dated and isn't very good advice really.”

It’s obvious from the number of recent 1-star reviews that there are some grey areas surrounding TRMIB, mainly due to the way the book is narrated and the religious sentiments it contains.

Lastly, another 1-star reviewer contemplated the relevancy of the text:

“Many consider this a great book in an introduction to personal finance, but to me, it was a very mediocre read. I found it extremely hard to keep on reading the book as there was nothing new mentioned in the book.

Every other finance book out there teaches us at least one new thing but this book kept on presenting the same ideas repeatedly in an extremely dull way.”

So, there’s redundant information throughout the book and plenty of outdated language (especially concerning women), but there are some valuable lessons even if they’re simple reminders of savings principles.

Key Takeaways from The Richest Man in Babylon 🌟

As with every book out there, every single reader is going to walk away from reading TRMIB with a different lesson that stuck out or inspired them. Others will walk away with a less memorable experience.

Personally, some of the biggest lessons that I learned from TRMIB were not so much the basic savings practices that several of the parables hinted at, but the deeper messages about determination, devotion, and will (which are underlying themes in the book).

There were several instances where characters experienced extreme setbacks in the finance department, but by using some of the savings principles mentioned and some extra elbow grease, they were able to make good on their loans, surpass their savings goals, and become successful beyond their wildest dreams.

Maybe I connect with those types of stories because I too have found light at the end of the tunnel after enduring hardship. And since the parables are set in ancient Babylonian times, I think the book shows that despite a negative financial situation (even in the worst of times— including eras of slavery), things can improve.

With saying that, I can see how some of the parables can seem extreme and unrelatable for the same reasons (which I found as well).

The Makes vs The Misses: The Richest Man in Babylon

Before I wrap-up this review, I’ll give you a brief summary of what I think made or missed the mark in The Richest Man in Babylon. Let me know if you agree with the points below in the comments!

The Makes

structure of the book encourages you to reflect on each chapter and leave with a key takeaway

narrated in a story-like way

takes a back-to-basics approach

a good starting point to learn about major components of personal finance like saving and investing

highlights the importance of getting ahead early in life

The Misses (Through a Millennial’s Lens)

slightly redundant information and antiquated ideas presented throughout the book

could be interpreted as hard to read and out of touch

dated language, biblical feel

cringey attitudes about slavery

lack of female characters and perspectives

Conclusion

Don’t get me wrong, I think it’s worth your time to give TRMIB a read (and you’ll most likely get through it in a day), but the book didn’t change my life like it did for other readers.

I agree with many of the neutral reviewers on sites like Goodreads who mark TRMIB as a good jumping-off point for learning about saving and investing before diving into all the details. I also agree that it can act as a friendly reminder to practice healthy money habits.

For example, saving 10 per cent of your income may set you up for a more financially secure. That said, saving money (a.k.a putting it in a place where you cannot touch it) is not the only thing that will make you money.

The book does touch on investing in some parables where characters funnel money back into businesses, but there’s not a ton of talk about the other investing strategies.

On another note, I think that TRMIB could’ve benefited from some female characters and perspectives but given the time period that the book is set in, it’s easy to see how the author could’ve been influenced to leave women out of the equation.

There are some extremely questionable bits about slavery throughout the book, like when Clason attempts to describe a slave labourer’s “victim mentality.” Then again, the era he lived in and the era the book is set in could’ve influenced those remarks as well.

Overall, TRMIB can be interpreted in many different ways. The great thing is, you’ll most likely come across something in the book that reminds you of how you can be smarter with your money.

Fave Quotes 💬

“Opportunity is a haughty goddess who wastes no time with those who are unprepared.”

“Willpower is but the unflinching purpose to carry a task you set for yourself to fulfillment.”

“Better a little caution than a great regret.”

“Where the determination is, the way can be found.”

“Remember, work, well-done, does good to the man who does it.”

Where to Buy The Richest Man in Babylon

#RequiredReading refers to $HMONEY’s official book club. I review books in the personal finance genre several times a month, including titles related to personal finance such as lifestyle and mindset books. Have a book you want me to review before you dive in yourself? Send me a message! Happy to have you join in on the fun and learning 💚

Like this book review? Check out my review of The Financial Diet next.

Start with the end in mind, and this guided reflection will help you put a whole new spin on money and meaning.