How to Make A To-Don't List

How to Make A To-Don’t List

06.13.2023 - By: Anastasia Barbuzzi

Doing the hard things is never easy. Life isn't all sunshine and rainbows, and I'm the first to admit to being a bit of a cynic (and equal parts shining light 😌). I think balancing out an overwhelmingly (and annoying) positive attitude with a bit of cynicism is relatively healthy and grounding.

So, suppose you're anything like me and prefer to see the world through clear lenses instead of rose-coloured ones or even reject the idea of trying to see only the pleasant things about a situation. In that case, you might be relieved to hear that there's nothing wrong with that— negative thinking can be just as powerful as positive.

The other day, I read something about the often controversial American author Arthur C. Brooks and his thoughts on negative thinking: "Peppering your perspective with a dash of pessimism is an ancient approach to life improvement called, 'via negativa.'" But how can one benefit from it?

When you don't know the right way forward, you might succeed by focusing on what you know to be wrong instead. In other words, instead of formulating a plan for the most favourable outcome, zoom in on what you don't want to do or agree with.

It's from this concept that the "new" Girlboss proposed we start making to-don't lists in addition to our regular to-dos, and I have to admit, I like this idea. All you have to do is think about the things you hate doing daily and jot them down, giving you time to assess and identify why you dread those tasks.

Immediately after reading about this, I thought of how beneficial this practice can be for our overall well-being, money mindset, and our relationship to it. This "brain dump"-esque activity can help you get a lot off your chest and reflect on your money habits and beliefs. It allows you to get to the root of an issue and simultaneously let it go or take the next step and make a change.

For example, on your to-don't list, you could write down something as simple as, "check my banking app," "tell myself I'm bad with money," or even, "do all the house chores for my husband without pay."

We're so used to actioning our to-do lists, but a to-don't list triggers an adverse reaction— it forces us to practice restraint healthily.

Isn't it an exciting thought to not reward yourself for productivity but for actively resisting? Checking off a to-don't list offers a new sense or definition of 'accomplishment,' and not in a 'don't buy a latte every morning' or 'spend a dollar' kind of way.

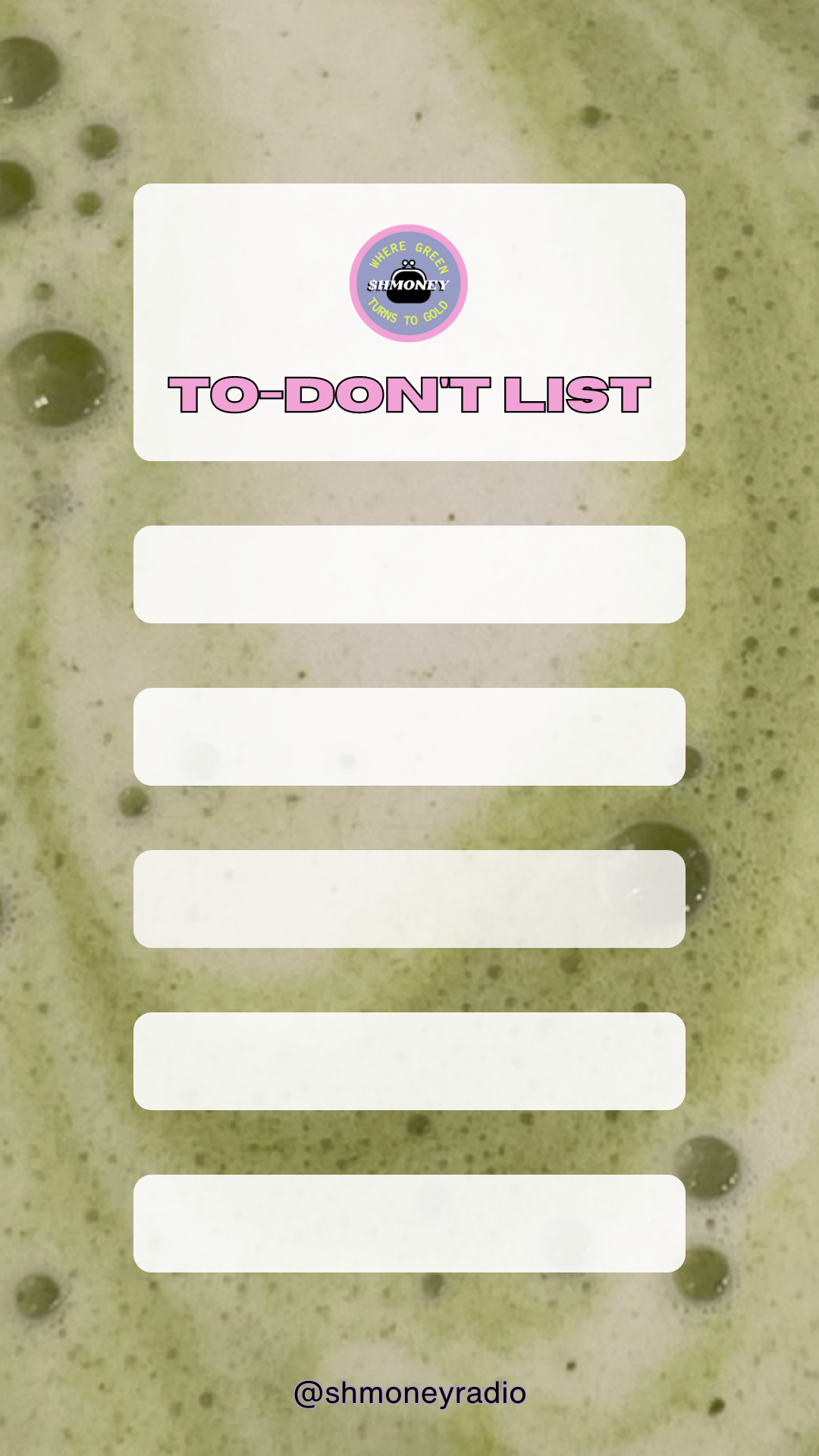

So, why not try creating a to-don't list while enjoying your coffee or tea with me? You can download one of the templates I made for you below, and if you're open to sharing a finished copy with me, you can send it to me via email or share it with me on social and tag @shmoneyradio.

Happy to-don't-ing!

Make creating a to-don’t list a morning ritual with one of the coffee or matcha options below! Hot or iced.

Thoughts? Questions? Leave them in the comments below!

The dopamine hit of your tax refund landing in your account? Unmatched. But before you blow it all, here’s how to stretch that sweet surprise into something way more satisfying.