A Brief History of Women's Financial Freedom + Tips for Using And Building Good Credit

A Brief History of Women's Financial Freedom + Tips for Using And Building Good Credit

04.19.2024 - By: Anastasia Barbuzzi

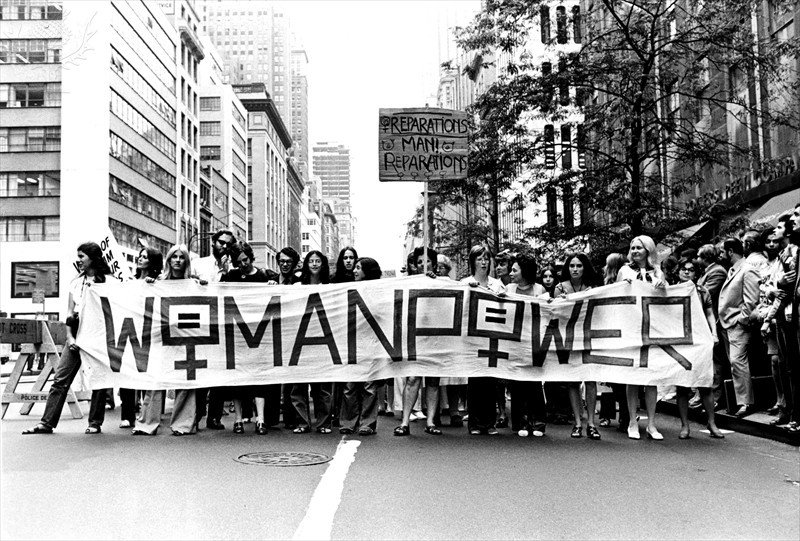

Only 50 years ago, access to credit wasn't considered a woman's civil right. We were not allowed to control our own banking decisions.

A little more background: the first modern credit card was the Diners Club "charge card," introduced in 1950 to help businessmen pay for restaurant meals. AMEX started issuing its charge cards in 1958, and Visa and Mastercard launched in 1966.

Before 1974, if we wanted to open a credit card, we'd be asked if we were married or whether we planned to have children. If we were married, there was slight potential we could get a credit card with our husband. Single, divorced, or widowed women couldn't get a credit card— a man had to cosign their application.

Then, BAM. The Equal Credit Opportunity Act changed everything. It made it illegal for companies to deny people credit based on their gender, race, religion, or national origin.

Jokes on the men who decided women shouldn't have control over their own money or have access to credit - it was awful for biz. Think of all the money banks and credit card companies have made from us in the last 50 years. We've built billion-dollar businesses, contributed positively to the global economy and civil rights movement, gained autonomy in our relationships, and much more that *everyone*- not just women- continues to benefit from today.

Access to credit is key to financial freedom. Think about a woman, maybe someone you know, who was able to leave an abusive relationship, start a business, manage her own bills, or even treat herself to something proudly, thanks to having credit—thanks to having options and opportunities.

Fellas, we're better off when everyone can participate in the free market economy. Financial inclusion makes all of us richer 💳✨

Keep reading for some key ways to responsibly use and build your credit!

7 Ways to Responsibly Use & Build Your Credit

1. Establish Individual Credit: Many women may have shared credit accounts with spouses or partners. While joint accounts can be beneficial for specific financial goals, it's also essential for women to establish and maintain individual credit history. Having your own credit accounts ensures that you have a credit history in your name and access to credit when you need it.

2. Negotiate and Advocate for Yourself: When applying for credit or negotiating loan terms, don't hesitate to advocate for yourself and negotiate favourable terms. Women sometimes face gender biases in financial transactions, so asserting your financial knowledge and standing up for your interests is critical.

3. Set Financial Goals: Define your financial goals and develop a plan. Whether building an emergency fund, saving for retirement, or buying a home, having clear goals can help guide your financial decisions and motivate you to manage credit responsibly.

4. Make Timely Payments: Paying your credit card bills and loan payments on time is one of the most significant factors in determining your credit score. Late payments can negatively impact your credit score, while consistently making timely payments demonstrates your reliability as a borrower.

5. Keep Credit Utilization Low: Credit utilization refers to the ratio of your credit card balances to your credit limits. Keeping this ratio low, ideally below 30%, shows that you are not overly reliant on credit and can manage your finances effectively.

6. Maintain a Mix of Credit Types: A diverse mix of credit types, such as credit cards, instalment loans, and mortgages, can positively impact your credit score. It demonstrates your ability to manage different types of credit responsibly. However, opening multiple new credit accounts within a short period can signal financial instability to lenders and may lower your credit score. It's generally advisable to only apply for new credit when necessary and to space out applications over time.

7. Regularly Monitor Your Credit Report: Keeping an eye on your credit report allows you to identify any errors or fraudulent activity that could potentially harm your credit. Stay on top of your credit health by using free credit monitoring services or signing up for credit alerts to receive notifications of any changes to your report.

In conclusion...

Building good credit takes time and consistent effort, but the rewards include access to better loan terms, lower interest rates, and increased financial flexibility and freedom in the future.

P.S: Tap or click here to subscribe and receive a weekly #SundayScroll ☕, my thoughtfully curated newsletter!

Did you like this post or find it helpful? Have any thoughts? Questions? Leave ‘em in the comments below 💚

The dopamine hit of your tax refund landing in your account? Unmatched. But before you blow it all, here’s how to stretch that sweet surprise into something way more satisfying.